Webinar with Joseph Yam:

The Outlook of Hong Kong as an International Financial Centre

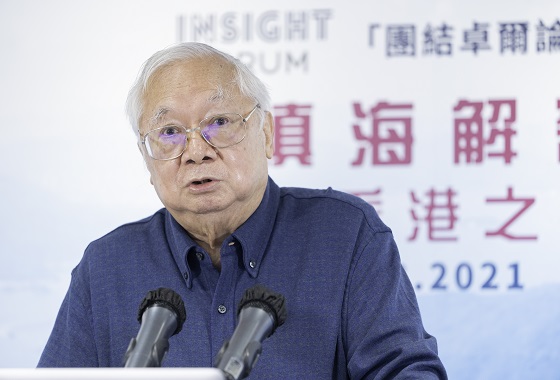

The combination of social unrest, Covid-19 and deteriorating Sino-US relations is presenting Hong Kong with unprecedented challenges. In this connection, doubts have been raised on the sustainability of Hong Kong as an international financial centre and the 37-year-old Linked Exchange Rate System. The Our Hong Kong Foundation (OHKF) today organised the sixth session of ‘INSIGHT FORUM’ with Joseph Yam, Former Chief Executive of the Hong Kong Monetary Authority, and Non-official Member of the Executive Council of the HKSAR Government, who shared his insight on the status of Hong Kong as an international financial centre and the future outlook of its monetary system.

A ‘No-Frills Approach’ to Maintaining Hong Kong as an International Financial Centre

On the maintenance of the status of Hong Kong as an international financial centre, as mandated in the Basic Law, Mr Yam advocated a ‘no-frills approach’ with a sharp focus on the fundamental role of an international financial centre, which he put as ‘the mobilisation of money between investors and fund raisers and between mainland China and the rest of the world’. He was of the opinion that some of the rankings and labels used to gauge international financial centers are not particularly meaningful and may reflect the activity of self-serving financial intermediaries in developing their businesses rather than the fundamental purpose of finance in serving the economy.

The National Security Law to be a Foundation for the Return of Social Order

On the social unrest that has been troubling Hong Kong, Mr Yam was concerned about the associated real threat to personal safety that had been intensifying. If not checked, he was of the opinion that it might eventually lead to an outflow of financial talents, to the extent of undermining the status of Hong Kong as an international financial centre. He therefore welcomed the enactment and application of the National Security Law in Hong Kong to serve as a foundation for the return of social order in Hong Kong.

Appropriate and Affordable Government's Fiscal Response to Cope with Covid-19

On Covid-19, Mr Yam expressed confidence that, with the very substantial financial resources, notably the accumulated fiscal reserves amounting to about HK$1.2 trillion, and a track record of prudent fiscal management, the Government’s fiscal response was entirely appropriate and affordable. The running of a large but temporary budget deficit would not erode the fiscal discipline in Hong Kong that has been underpinning the status of Hong Kong as an international financial centre.

Possibility of ‘Weaponisation’ of Finance by the US to Handle China

On the deteriorating Sino-US relations, Mr Yam pointed to the possibility of the ‘weaponisation’ of finance by the US and noted that, given the sheer size of the US financial system and specifically the dominance of the US dollar in the international monetary system, ‘the US has a powerful arsenal at its disposal’. However, he also drew attention to the financial profligacy of the US and its abuse of, to quote from Stephen Roach, Senior Fellow at Yale Jackson Institute for Global Affairs, ‘the US dollar's exorbitant privilege as the world's primary reserve currency’, referring to the huge net international indebtedness of the US, amounting to about US$12 trillion, and its lousy macroeconomic scorecard. ‘Deploying the powerful arsenal could well end up hurting itself badly,’ Mr Yam said.

Linked Exchange Rate System to Remain as Robust as Ever

Going forward, Mr Yam recommended several strategies for Hong Kong's further development as an international financial centre. These included: staying focused on the fundamental role of an international financial centre, which for Hong Kong is the mobilisation of money between mainland China and the rest of the world; being proactive in promoting the use of Fintech in the delivery of financial services in the post Covid-19 new normal era; internationalising further the RMB through facilitating its wider use in capital markets in Hong Kong; and playing a leading role in the development of Great Bay Area finance.

On the 37-year-old Linked Exchange Rate System, Mr Yam said that it remained as robust as ever, bracing the various shocks that Hong Kong had been experiencing, and the malicious rumours about capital flight and predictions about sharp depreciation with considerable ease. ‘Substantial capital inflow and a strong exchange rate said it all,’ Mr Yam said.

‘The Outlook of Hong Kong as an International Financial Centre’:

Full live webinar: https://youtu.be/xzZgg7mwj0Q?t=49