Our Hong Kong Foundation Proposes Housing Policy Recommendations:

An “Affordable Homeownership for All Hong Kong People” Initiative

(25 September, 2019, Hong Kong) Our Hong Kong Foundation (OHKF) published the latest housing policy proposal, in which it recommends bringing Hong Kong people their very own version of affordable homeownership. It is envisioned in the proposal that, through a set of ten policy recommendations such as Tenants Purchase Scheme 2.0 (“TPS 2.0”), a Buy-or-Rent Option for new public housing, rent subsidies, fixed premium, and interest-free loans to first-time buyers, all citizens of Hong Kong would gradually be able to live in their own living space with dignity, leading to the fulfilment of the goal of “affordable homeownership for all”.

Providing Additional Housing Options and Rebuilding the Ladder to Homeownership

Mr C.H. Tung, Chairman of the OHKF, had proposed the long-term housing objective of reaching a homeownership rate of 70% during his term of office as the Chief Executive of the HKSAR. In the past four years, OHKF has published three research reports on housing, all of which suggested an adjustment of public housing policy direction — from the present rental model to a Buy-or-Rent model — in order to provide more housing options and rebuild the ladder to homeownership.

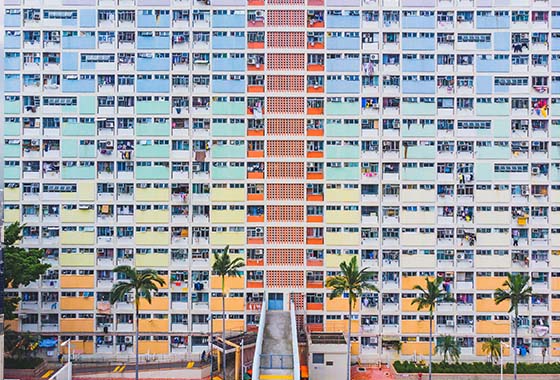

Many people in society regard the “HDB flats” in Singapore as an effective policy for solving Hong Kong’s housing problems. At present, about 80% of Singapore people live in “HDB flats” that their government provides. Among HDB flat residents, 90% are owners and 10% are tenants. On the whole, more than 90% of Singaporeans possess their own properties.

The new initiative of "Affordable Homeownership for All Hong Kong People ", proposed by OHKF, has made reference to the Singaporean model and outlined a viable path based on the circumstances in Hong Kong. The ultimate goal is to enable 70% to 80% of Hong Kong citizens to eventually become owners of permanent properties. This initiative, comprising ten policy recommendations, aims at providing assistance for the achievement of homeownership for all sectors of the society: Existing Public Rental Housing (PRH) tenants, households on the PRH waiting list or currently living in sub-divided units, owners of subsidised sale flats with unpaid premium, White Form households, and young first-time home buyers.

Ten Housing Policy Recommendations to Benefit Five Communities

I. For Public Rental Housing Tenants

1. Re-launching "TPS 2.0": By re-launching the "Tenants Purchase Scheme" (“TPS 2.0”) to the full extent, it allows the majority of PRH tenants an opportunity to purchase their current rental units. Increasing the Government's funding for the Maintenance Reserve Fund and re-examining the boundaries of TPS estates will make it possible to address TPS’s administrative problems, which were criticised in the past.

In determining the sale price, OHKF proposes to refer to the old TPS and set a unit’s price at 25% of the average market price. The premium should be fixed at the level on the day when the unit is launched for sale, meaning that the premium will not be subject to increase along market prices. If the unit is transferred to a Green Form or White Form household in the secondary market, the unit owner may carry out the transaction without having to pay the premium beforehand. Additionally, restrictions on renting and transferring units with unpaid premium in the secondary market should also be relaxed.

2. Optimising the Public Rental Housing (PRH) transfer mechanism: In conjunction with the re-launch of TPS 2.0, a public platform should be established to ensure convenience and flexibility in processing PRH transfer requests. Using this platform, PRH tenants may exchange their flats in a free and multilateral manner, thereby reducing mismatch between units and residents, and enabling residents to live in their desired homes.

II. For Households on the Public Rental Housing Waiting List / Currently Living in Sub-divided Units

3. Providing a Buy-or-Rent Option for new Public Rental Housing (PRH): Prospective PRH applicants should be able to freely choose either to rent or purchase new public housing units. Applicants who choose to rent may also reserve the right to purchase their unit in future.

4. Providing rent subsidies: Considering that the current waiting time for PRH is 5.4 years, the Government may provide rent subsidies for households at the top of the public housing waiting list, in order to relieve people’s rental pressure during the waiting period. The Government may also set up a quota that is based on the cumulative shortfall between its actual completion and annual supply target.

5. Reapportionment of more land for Public Rental Housing (PRH): Under the condition that the overall supply of housing units is increased, some private residential land may be reallocated for public housing use, with the view of increasing the supply of public housing.

III. For Owners of Subsidised Sale Flats With Unpaid Premium

6. Fixing the premium: In order to facilitate subsidised sale flat owners’ payment of the premium to obtain “real ownership”, OHKF proposes to optimise the existing mechanism such that the premium will be fixed for existing and future newly-completed subsidised sale flats on the unit’s sale launch date and will not be subject to increase along market prices.

7. Relaxing rental and sales restrictions: All owners of subsidised sale flats with unpaid premium should be allowed to rent out their flats to all eligible Green and White Form households. This will revitalise the secondary market for subsidised sale flats with unpaid premium, releasing a large number of idle or underutilised living space to alleviate housing shortage in the short term. After selling their previous subsidised sale flats with unpaid premium in the secondary market, all owners should then be allowed to buy another flat with unpaid premium from the said market. This will help drive the turnaround of units and enhance their usage efficiency, ensuring that the units meet the actual needs of residents.

IV. White Form Households

8. Fully opening up the White Form Secondary Market (WSM): Relying solely on the supply of newly completed subsidised sale flats and the 3,000 units through the quota system for the WSM would not be sufficient to meet the demand of White Form households. The Government ought to increase the WSM quota as soon as possible so that more White Form households may be allowed to purchase subsidised sale flats with unpaid premium from the secondary market, thus giving these households greater homeownership opportunities.

9. Refining the balloting mechanism for new Home Ownership Scheme (HOS) units: It is suggested that the mechanism should be refined so that the success rate of applicants with multiple failed applications will be improved. With the full launch of "TPS 2.0", the homeownership opportunities for Green Form households will be much better, and as a result, the Government may consider allocating more new units to White Form households to fulfil their homeownership aspirations.

V. Young first-time buyers

10. Interest-free loans to first-time buyers: The Government may provide interest-free loans to young people, who are first-time buyers not eligible for the HOS due to income level restrictions, to purchase property with a capped price at $8 million. The required down-payment may be lowered to 10% of the property’s price, while interest-free loan together with the mortgage by the bank may cover the remaining 90% of the price. Appropriate limits on age, income and asset can be imposed. Units purchased under this loan scheme may either be first-hand or second-hand private homes (including HOS units with paid premium and TPS units).

Mrs Eva Cheng, Executive Director of the OHKF, believes that the current social situation reflects how the past housing policy is no longer sustainable. The Government must address the deep-seated conflicts to their root, commit an unprecedented degree of courage and resolution, and implement sweeping housing policy reforms. “The Government must speed up the launch of a response plan in a faster, stronger and more precise manner in order to rekindle hope in our society,” said Mrs Cheng.

Professor Richard Wong, member of the OHKF Research Council and Professor of Economics and Philip Wong Kennedy Wong Professor in Political Economy of the University of Hong Kong, expressed his hope for the Government to launch the TPS 2.0. As he pointed out, “The ‘TPS’ not only narrows the gap between the rich and the poor, but can also unleash the potential value of land for the creation of wealth in society and drive economic development. The scheme can also exude a positive effect on the labour market and family stability, while improving the usage efficiency of existing public housing resource usage and boosting resident numbers in underutilised units. As such, the pressing problem of housing shortage may be alleviated in the short to medium term.”

Professor Pak-wai Liu, member of the OHKF Research Council, Research Professor of the Lau Chor Tak Institute of Global Economics and Finance and Emeritus Professor of Economics of the Chinese University of Hong Kong, observed that many young people are unable to afford housing as their current rate of saving fails to keep up with the increase in property prices. The Government should grant interest-free loans to first-time buyers as soon as possible, so that it may “allow more young people to gain a share of economic prosperity and asset appreciation.”

In addition to the above policy recommendations, Mr Stephen Wong, Deputy Executive Director and Head of the Public Policy Institute of the OHKF, suggested that it is the OHKF’s ultimate vision to see the construction of a large number of housing units. A substantial increase in land supply is a prerequisite for achieving such a vision. “In the long term, we must adopt an infrastructure-focused planning model to increase land and housing supply under the leadership of the Government. This, coupled with the recommendations we have proposed above, will help achieve affordable homeownership for all.”

According to Mr Ryan Ip, Head of Land and Housing Research of the OHKF, the OHKF also recommends a gradual lifting of income limit for eligible purchases of public housing, if supply permits, in order to benefit more Hong Kong people. “The Government may consider an early allocation of public housing units that have been planned for completion in the future as a measure to redouble its commitment to eligible tenants and buyers. The ensuing public pressure will help streamline and simplify the approval procedures, and speed up the process of land development.”