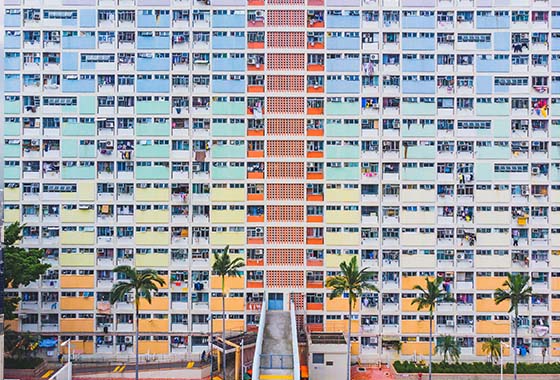

Affordable housing is still achievable in Hong Kong

This article appeared originally in the China Daily on 15 October, 2019.

Authors: Ryan Ip, Head of Land and Housing Research, and Iris Poon, Researcher at Our Hong Kong Foundation

Housing has always been a major problem for many of us and our governments. Over the years the housing system has grown so complex and obstructed the government in pushing forward with radical reform. The chief executive is due to announce another Policy Address this week. We really hope there will be a change of heart on the matter and that society, by and large, will support the reform of our housing system.

Our Hong Kong Foundation recently released its housing policy outline, Vision of Universal Affordable Housing in Hong Kong. Many people in society regard the “HDB (Housing and Development Board) flats” in Singapore as an effective policy to cope with our housing problems. At present, about 80 percent of Singaporean people live in the HDB flats that their government provides. Among HDB-flat residents, 90 percent are owners and 10 percent are tenants. On the whole, more than 90 percent of Singaporeans possess their own properties. Our proposal has made reference to the Lion City and outlines a viable path based on Hong Kong’s own circumstances. The ultimate goal is to enable 70 percent to 80 percent of Hong Kong citizens to have the option of becoming property owners. Eventually, we hope there will be two relatively segregated housing markets in Hong Kong. Namely, the subsidized housing market and the private housing market, both of which should be internally circulating.

In the past 15 years, our median household income has increased by 80 percent but the property prices have risen more than fivefold. The result is an ever-decreasing homeownership rate that limits the proportion of households that can enjoy rising property prices and asset appreciation.

We are seeing a bizarre phenomenon in society where the “have-nots” worked extremely hard to try to catch up with property prices and save for the down payment while the “haves” seem to live in parallel time and space seeing their assets appreciate through property prices. A completely broken housing ladder has denied the grassroots in society any sense of hope or motivation that they can achieve financial and social status. Instead, it is giving them a sense of powerlessness and resentment. The housing problem in Hong Kong is, therefore, what we only see on the surface. What is under the skin is a widening wealth gap between the haves and have-nots, which in turn propels a loss of social mobility and a sense of social injustice among the have-nots.

Through a set of 10 policy recommendations, our proposal this time aims to help five groups including the Public Rental Housing (PRH) tenants, households on the PRH waiting list or currently living in subdivided units, owners of Subsidised Sale Flats (SSF) with premiums unpaid, White Form households and young first-time homebuyers.

Among the 10 policy recommendations we made, a major one is relaunching a refined version of the Tenants Purchase Scheme on a large scale. The Tenants Purchase Scheme is a program that offers PRH tenants an opportunity to purchase their current rental units.

Our proposed plan is based on the original version of the Tenants Purchase Scheme (TPS), but improved by two moves — via fixing the premium and relaxing the rental and sales restrictions of units. We propose to refer to the old TPS and set a unit’s price at 25 percent of the market price. The premium should be fixed at the level the day when the unit is sold, meaning that the premium will not be subject to increases subject to market prices. If the unit is transferred to a Green Form or White Form household in the secondary market, the unit owner may carry out the transaction without having to repay the premium beforehand. Additionally, restrictions on renting and transferring units with premiums unpaid in the secondary market should also be relaxed.

The program will allow tenants to own an affordable home and unlock the value of land for wealth creation and economic development in society. The program can also have a positive effect on the labor market and family stability. It will help use existing public housing resources more efficiently and boost resident numbers in underutilized units.

Very similar to our recommendation of relaunching the TPS, we also recommend that PRH applicants be able to freely choose either to rent or purchase new PRH. Applicants who choose to rent may also reserve the right to purchase their units in the future.

To mitigate the effect of lower return rate of PRH units, we propose that the government provide rent subsidies to households at the top of the public housing waiting list, to relieve people’s rental pressure during the waiting period. Under the condition that the overall supply of housing units is increased, some private residential land should also be reallocated for public housing use.

Since the government relaunched Home Ownership Scheme new units for sale, the demand from White Form families has been overwhelming. For instance, in the sale, launched in 2018 and 2019, the government received 236,000 and 262,000 White Form applications respectively, and both were oversubscribed by 107 times.

Relying solely on the supply of newly completed SSFs and the 3,000 units through the annual quota system for the White Form Secondary Market (WSM) would not be sufficient to meet the demand of White Form households. The government ought to increase the WSM quota soon so more White Form households are allowed to purchase SSFs with premiums unpaid from the secondary market, thus giving these households greater homeownership opportunities. Besides, the government should also consider allocating more new Home Ownership Scheme units to White Form households to fulfill their homeownership aspirations. We also suggest the balloting mechanism be refined so the success rate of applicants with multiple failed applications will be improved.

We also have a policy recommendation for young first-time buyers. We recommend the government provide interest-free loans to homebuyers not eligible to buy subsidized flats due to income cap rules. The purpose is to reduce the down payment to 10 percent of the property value, and buyers can get an overall 90 percent mortgage. Appropriate limits on age, income and assets can be imposed. Units purchased under this loan plan may either be new or secondhand private homes (including HOS and TPS units with premium paid). The program may allow more young people to gain a share of economic prosperity and asset appreciation.

Together, the 10 recommendations will both alleviate the housing shortage and enable more people to become property owners. Of course, these policies must go hand in hand with a continual increase in land and housing supply. In the long run, an infrastructure-led planning approach is most recommended. The housing policies of Hong Kong must move with the times, with a multipronged and agile approach to solve a myriad of long-standing problems.