Economic Development | Policy Research Series

2021-09-13

Central Bank Digital Currency: The Cornerstone of Digital Financial Infrastructure

[Full Report (Read Flipbook)]

[Executive Summary (Read Flipbook)]

[Presentation Slides (Read Flipbook)]

[Full Report (Download PDF)]

[Executive Summary (Download PDF)]

[Presentation Slides (Download PDF)]

The coronavirus disease (COVID-19) has changed our traditional ways of life, with “contactless” becoming the latest buzzword, and business models becoming increasingly digitalised. The concept of Central Bank Digital Currency (CBDC) is thus growing in appeal to the general public.

CBDC is a legal tender issued by central banks in digital form. There are two types of CBDC: retail CBDC and wholesale CBDC. Retail CBDC is primarily designed for the public, including households and businesses, and is an innovation on the payment front (retail HKD CBDC is hereinafter referred to as “e-HKD”). Wholesale CBDC is primarily designed for financial institutions, with one primary function to provide a new method for interbank settlements, especially for cross-border settlements (wholesale HKD CBDC is hereinafter referred to as “w-CBDC HKD”).

Currently, 86% of central banks worldwide now conducting CBDC related research. While the development of retail CBDC will bring convenience to the public, wholesale CBDC will serve as the core infrastructure for Hong Kong’s transformation from a traditional financial centre to a digital financial centre.

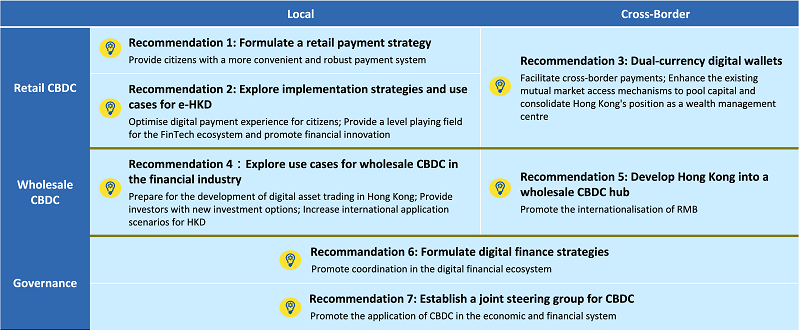

This report is structured into three different areas: retail CBDC, wholesale CBDC, and governance, offering seven recommendations in total. This report aims to explore how Hong Kong can take full advantage of the opportunities offered by CBDC and assume a leading role in the new era of digital finance.

On the retail front, Hong Kong should formulate a comprehensive and overarching retail payment strategy to optimise the daily payment experience of citizens (Recommendation 1), explore local implementation strategies and use cases for e-HKD (Recommendation 2), and launch a dual-currency digital wallet for cross-border commuters that travel between the Mainland and Hong Kong (Recommendation 3).

On the wholesale front, Hong Kong should explore the application of wholesale CBDC in the financial industry to encourage process optimisation (Recommendation 4). Hong Kong should also aim to develop itself into a wholesale CBDC hub by connecting w-CBDC HKD with other CBDCs (Recommendation 5).

Lastly, in terms of governance, Hong Kong should formulate comprehensive digital finance strategies (Recommendation 6) and have the Hong Kong Monetary Authority set up a CBDC joint task force with the Financial Services and the Treasury Bureau (Recommendation 7).

A new era of digital finance is forthcoming, with CBDC being an integral part of this modern age. As the world’s traditional international financial centre, it is imperative for Hong Kong to make full use of its numerous advantages to facilitate the development and implementation of CBDC, with a view on ushering in a new era of digital finance for the city.

2018-09-10

Re-emergence of Glittering Stars

[Download Full Report]

[Download Presentation Slides (Chinese)]

Our Hong Kong Foundation (“OHKF”) has released an advocacy report today on the Hong Kong film industry, titled “Re-emergence of Glittering Stars”. Hong Kong’s film industry has seen the emergence of numerous talented professionals and the rapid growth of the Asian and Mainland Chinese market. Meanwhile, leading foreign film companies have been actively entering the Mainland Chinese market via Hong Kong, rendering unique opportunities to Hong Kong’s film industry practitioners. Hong Kong must formulate appropriate policies to offer both veteran and young filmmakers more room to realise their full potential, with the vision of revitalising the city’s film industry and making it an “International Film Hub”. Presenting policy recommendations in three areas — financing, production, as well as distribution and promotion — this report highlights ways to develop the Hong Kong film industry towards greater success and higher repute.

2016-09-08

Yes,Hong Kong CAN!

Our Hong Kong Foundation released its research report on economic development of Hong Kong. Given what has been occurring in the economies of the Mainland and the world, the economy of Hong Kong is now at a turning point. It must embark on new directions in order to continue to grow and prosper. The purpose of this report is epitomized by the Chinese saying, “tossing a brick to attract the jade (抛磚引玉)” to give out a menu of the available possibilities. It is entirely possible for Hong Kong to become the leading international financial center of the whole world. It is also possible for Hong Kong to become an international center of innovation and venture capital, an international center of creative arts and film making, and an international educational, health care and legal services center in the East Asian region, serving not only Hong Kong and the Mainland, but also the rest of East Asia and the world. Hong Kong still has great potential for further economic growth. Yes. Hong Kong CAN create yet another economic miracle!