Let public housing tenants own their own homes

This article appeared originally in the South China Morning Post on 6 Nov 2020.

Authors: Amy Liu, Managing Editor at Pur Hong Kong Foundation

With property prices beyond the affordable level of many young people for over a decade now, some were hoping the COVID-19 pandemic would trigger a market correction that provides an opportunity for prospective buyers to pick up some bargains. However, the market collapse seen during the SARS epidemic was not repeated this time. While there were price fluctuations and discounts, the market would come alive again whenever there were signs the pandemic was easing. Real estate experts expect strong demand in both the primary and secondary markets, thanks to the low interest rate environment and the strong fundamental demand.

The pandemic seems to have affected the stock market much more than the property market so far. While technology stocks have been doing slightly better, many blue-chip shares have fallen sharply. Whereas real estate prices more or less have stood firm, with the CCI Index compiled by Centaline Property Agency hovering near the record high of 190 registered in July last year, prices at major private housing estates saw strong support. The myth that home prices would fall to affordable levels remains wishful thinking.

The benefit of private ownership is that the homeowners, as well as their children, will have a sense of security toward their future, which will help bring back harmony and stability to our community.

Whether prospective homebuyers can benefit from any bargains during this pandemic depends on their financial strength. With prices remaining sky high, only those people with a secure and high income will have the capacity to buy properties. The salaries of most of the working population simply cannot catch the ever-rising home prices, resulting in widespread concerns over their quality of life. Not only are the younger generation unable to afford to buy a flat, they are far from optimistic about the future.

Hong Kong’s property prices have remained the most expensive in the world for at least a decade, with Singapore and Shanghai coming third and fourth. High home prices have led to deep grievances among Hong Kong people. The surge in prices that began some 10 years ago triggered many social and economic problems. The “Occupy Central” movement in 2014 and the anti-extradition law amendment movement last year showed how volatile public sentiment is. It is not difficult to imagine that the deep-rooted problems are related to the lack of a bright future for many people as a result of high property prices, which have contributed to political instability. Professor Richard Wong Yue-chim from the University of Hong Kong has pointed out that if the public feel persistently frustrated, it could be a trigger for political movements.

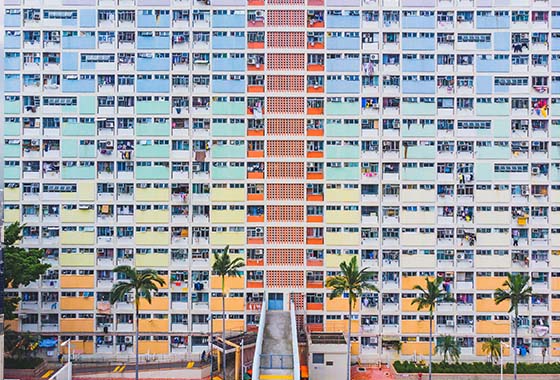

Currently, about half of Hong Kong’s households live in public housing, of which some 140,000 have bought their own flat under the Tenant Purchase Scheme. In addition to providing a sense of security, the price of these purchased flats will rise if property prices go up in the private sector, benefiting these homeowners. When they save enough money, they can then sell their old flat and buy properties in the private housing markets, thereby improving their living standards. This opportunity will give the homeowners more hope for their future, meaning less frustration.

Clearly, homeownership helps to bring stability to families. However, the special administrative region government stopped the Tenants Purchase Scheme in 2002, with 800,000 families unable to benefit from the program. Even though tenants in participating housing estates can still purchase their units, tenants of most rental public housing estates across Hong Kong cannot. The surge in property prices over the past decade means property owners benefit from rising asset values, while those without assets fail to reap the benefits of the affluent society, creating a wealth gap and constant complaints. Under the circumstances, the SAR government should relaunch the Tenants Purchase Scheme, as well as providing this purchasing option for tenants of newly completed public rental housing. This will enable more people to buy their own flat at a lower price, which will alleviate concerns over housing, while helping to improve overall political stability.

Research conducted in 2019 by political party Democratic Alliance for the Betterment and Progress of Hong Kong found 87 percent of public rental housing tenants supported the relaunch of the Tenants Purchase Scheme, with 76 percent saying they would buy the flats they now occupy if the program were relaunched. One of the main attractions of the program is the heavy discount for the units offered for sale. According to the Transport and Housing Bureau, prices in housing estates participating in the program range from HK$11,000 to HK$22,000 (US$1,418 to US$2,837) per square meter, which represent discounts of 82 to 86 percent on market value.

With or without the program, many factors keeping property prices high are unlikely to disappear anytime soon, such as the shortage of residential land and the low interest rate environment. On the other hand, the challenging economic situation means the salary growth of low-income families is unlikely to catch up with private property prices, giving most people little hope of owning a flat. So realistically, the Tenants Purchase Scheme offers a practical way for low-income residents to become property owners.

Under the pandemic, Hong Kong people are concerned about many things, whether it is the infections, unemployment, or finding a home. Though the government is continuing its fight against the pandemic while taking measures to bolster the economy, the administration must also address the community’s livelihood concerns, of which housing is the most serious. As such, the government should take measures to help more people own their own homes, which is a key to the stability of Hong Kong.

Instead of the Housing Authority being the sole landlord of public housing, the program allows a portion of the public housing units to be owned by residents, who may otherwise never be able to afford a flat and remain disgruntled toward society. Regardless of the ownership, all public housing units are accommodating Hong Kong people. But the benefit of private ownership is that the homeowners, as well as their children, will have a sense of security toward their future, which will help bring back harmony and stability to our community.